If Fred Continues to Buy and Sell Properties for His Own Portfolio While Licensed

xeni4ka

Last week, I wrote an article in which I argued that real estate investment trusts ("REITs") are expected to generate higher returns than rental properties because they enjoy many structural advantages and trade at materially lower valuations.

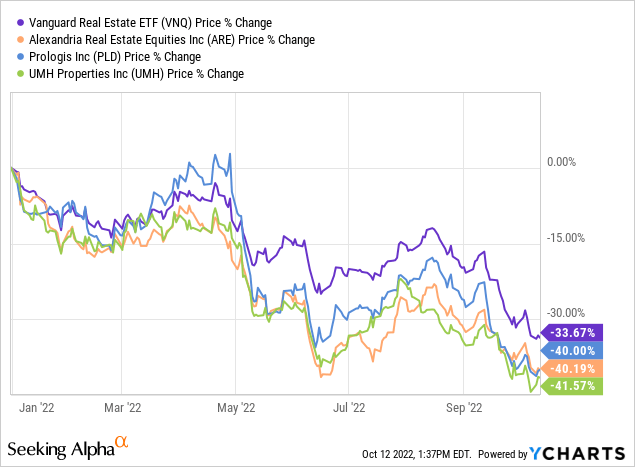

So far this year, REITs (VNQ) have dropped by 33% on average, and many individual REITs have dropped by closer to 40%. Good examples include Alexandria (ARE), Prologis (PLD), and UMH Properties (UMH).

Yet, the value of the real estate that they own has not changed materially. As a result, they are now priced at steep discounts relative to the value of the real estate they own.

As such, REIT investors today have the opportunity to buy real estate for as low as 50 cents on the dollar through REITs and enjoy the added benefits of diversification, professional management, limited liability, and liquidity - for free on top of it.

I believe that the lower valuation, coupled with all the structural advantages enjoyed by REITs, should result in higher returns than what's achievable for rental property investors.

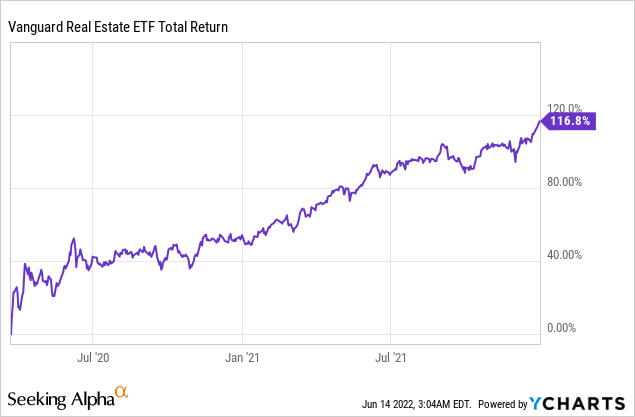

The last time REITs were so cheap, it was early into the pandemic when they sold off heavily, and they proceeded to more than double in the next year:

YCHARTS

But, to my surprise, many readers appeared to disagree.

Rental investors refuse to accept that people who simply buy REITs are likely to earn higher returns than them despite putting in a lot less effort and taking less risk.

The main pushback that I keep receiving in comment sections and via direct messages is that...

-

You can buy rental properties with mortgages.

-

Rental properties are more resilient to rising interest rates.

-

You enjoy significant tax advantages with rental properties.

... and so I decided to write this follow-up article focusing on these exact points because there are a lot of misconceptions that need to be addressed. Let's go over each of these three points one by one:

You can buy rental properties with mortgages

Rental property investors argue that REITs cannot compete with rental property investments because you can't buy them with a mortgage.

Naturally, if you are enjoying much greater leverage, then you are also expected to earn higher returns. Rental investors commonly buy properties with as much as 80% leverage in the form of a mortgage, which materially increases their returns.

But there is a major misconception here.

What rental investors appear to ignore is that REIT investors enjoy the exact same benefits of leverage - without actually having to take a mortgage themselves.

That's because what you are buying as a REIT investor is the equity. It is the equity value that's traded on the stock market. REITs then take this equity and add debt on top of it to leverage your investments.

Therefore, a $100,000 investment in a REIT will commonly represent $200,000 or even $300,000 worth of assets. What you see is the equity value but the vast majority of REITs also use leverage.

So it is wrong to say that REITs don't enjoy the benefits of leverage. The difference here is that REIT investors don't need to take on mortgages themselves. The REIT does it for you already. This is preferable because REITs are often able to get better terms than you would and it also protects your personal liability. As a shareholder of a REIT, you are never personally liable for all of the debt, but you still enjoy its benefits.

Besides, if you think that the leverage of a REIT is insufficient, you can always take on more debt with a margin loan or another source. This is not needed, but it is also an option for more aggressive investors.

Rental properties are more resilient to rising interest rates.

The second point that I have seen some investors make is that REITs are more heavily exposed to the risk of rising interest rates. They appear to justify this point by pointing out the recent drop in REIT share prices and comparing that to the greater resilience of property values.

But this logic is flawed.

Yes, REITs are down significantly in 2022, but this is not just because rising interest rates are negatively impacting the fundamentals of REITs.

REIT balance sheets are today the strongest in their history with just 35% LTVs on average, mostly fixed rate debt, and long maturities. Therefore, the impact on their fundamentals is not material. REITs have actually been growing their cash flow at a rapid pace in 2022 and more than 100 REITs have even hiked their dividend payments.

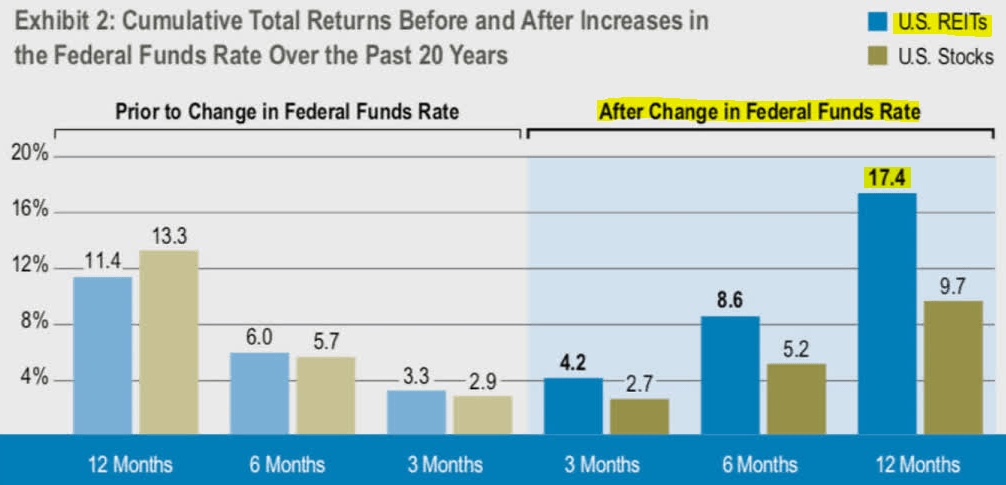

Historically, REITs have actually generated high total returns during most times of rising interest rates. On average, they have generated a 17% return in the 12 months following a rate hike in the past.

Cohen & Steers

So simply looking at the recent stock market performance is quite misleading and tells you nothing about the future. The stock market is volatile and does funny things at times, but the fundamentals of REITs are resilient to rising interest rates, and their valuations are also now heavily discounted, which should provide margin of safety.

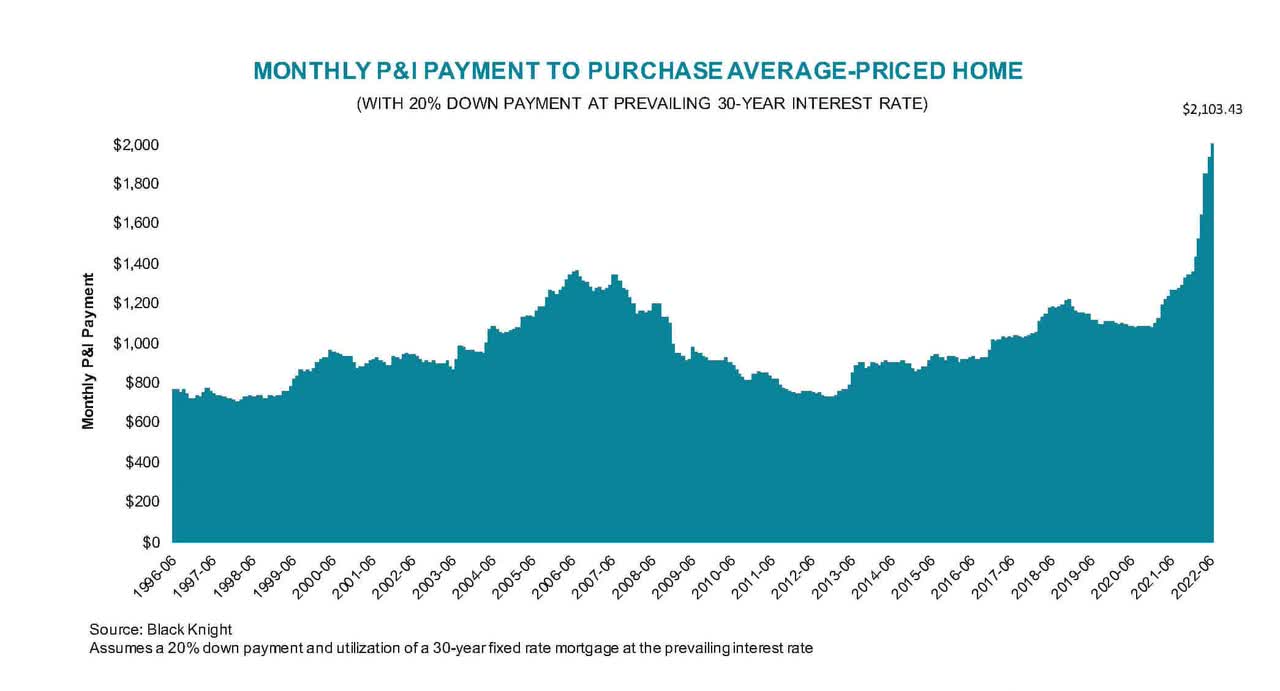

I would argue that rental properties are actually far more exposed to the negative consequences of rising interest rates. This is because most rental investors use far more leverage than REITs. Instead of 35% LTVs, rental investors will commonly use up to 80% LTVs to finance their properties. Because the debt was so cheap in recent years, the home market was getting bubbly. Now rates are rising and, as a result, home affordability has dropped to a multi-decade low:

Black Knight

This clearly shows you that the home market was artificially propped up by the ultra-low rates and that the past values may not be sustainable in today's rising rate environment. In other words, home prices are likely to drop in the future, hurting the returns of rental investors.

REIT investors are much better protected because:

-

Only 2 (AMH; and INVH) out of 200+ REITs invest in single-family homes. Commercial real estate is not as heavily exposed to rising interest rates.

-

REITs use a lot less leverage than most rental investors.

-

Unlike home prices, REIT share prices have already dropped heavily, which limits future downside risk and provides margin of safety.

You enjoy significant tax advantages with rental properties

The final argument of rental investors is that they enjoy considerable tax advantages that will allow them to outperform REITs.

Again here, there are lots of misconceptions that are causing rental investors to overestimate the tax benefits of rentals and underestimate those of REITs.

Yes, rental properties can be depreciated, which allows investors to defer the taxation of a portion of their cash flow. But depreciation isn't a tax break, it is just a deferral tool. It lowers the cost basis of your property, which means that you will be hit with an even larger tax bill in the future when you sell your property at a profit. You could defer the tax bill even further by doing a 1031 and redeploying the proceeds into another property, but again, you are just deferring taxes, not eliminating them. This also means that you are stuck with the real estate for the rest of your life, unless you accept to pay the tax bill. This could have significant indirect costs because you will lose flexibility. At times, real estate may become overpriced and unattractive as an investment. Even then, you won't be able to sell to reinvest elsewhere. Also, the 1031 rule has often been rumored to be eliminated and this is a real possibility sometime in the future.

REITs, on the other hand, also allow you to defer taxes by holding them in a tax-deferred account, but you enjoy much greater flexibility over your investment. If and when REITs become unattractive, you can easily sell them and reinvest elsewhere. Besides, REITs are very tax efficient even when held in a taxable account, and those tax benefits are severely underestimated:

-

REITs are fully exempt from all corporate taxes, but still give you the limited liability benefits of a corporation.

-

REITs typically only pay out 50-70% of their FFO in the form of dividends. This means that 30-50% of the cash flow is tax deferred since it is retained and reinvested by the REIT.

-

A portion of the cash flow that's paid in the form of dividends is typically classified as "return of capital" which is also tax deferred.

-

The portion of the dividend that's taxed enjoys a 20% deduction.

-

And finally, about 2/3 of REIT returns actually come from appreciation, which is also tax-deferred. REITs typically are faster growth / lower yield investments when compared to rental properties, which increases their tax efficiency.

So, no, rental properties do not enjoy material tax benefits that would make them a lot more rewarding than otherwise.

I actually pay fewer taxes investing in REITs than in rental properties.

Bottom Line

The reason why I like the topic of REITs vs. Rental properties is that there are strong opinions on both sides and there are lots of misconceptions.

I have invested in both and analyzed this topic for years. I have even written academic research papers about it. And the main conclusion is that REITs are rewarding in most cases, and this is particularly true when they are discounted relative to rental properties. This is the case today, and this is why I am buying REITs instead of rental properties.

High Yield Landlord, #1 Service for Real Estate Investors and Retirees

High Yield Landlord recently broke the 2500-member mark! Our prices will increase soon but all members who sign up now are grandfathered for life at today's discounted rate!

If you are still sitting on the sidelines… now is your time to act. Start your 2-week free trial TODAY and lock in this discounted rate before we hike it!

Want A 50% Discount?

Start Your Free Trial Today

We have over 500 five-star reviews from members who are already profiting from our 8% yielding portfolio.

Source: https://seekingalpha.com/article/4546221-why-i-stopped-buying-rental-properties-to-buy-reits-instead-part-2

0 Response to "If Fred Continues to Buy and Sell Properties for His Own Portfolio While Licensed"

Post a Comment